Being a professional trader is about having a stable, robust methodology for examining the market, developing trading ideas, selecting the best possible implementation, efficiently executing the trade, and monitoring and optimizing the resultant position.

Each chapter of Trader Construction Kit addresses a specific aspect of the process:

Chapter 1 – Know Yourself

What does it mean to be a professional trader? What sorts of character traits are markers for success, and what behaviors inevitably lead to ruin? Not all traders do the same thing, and there are a variety of different decision-making styles and approaches to the market that can be productively deployed.

Chapter 2 – Know the Enemy

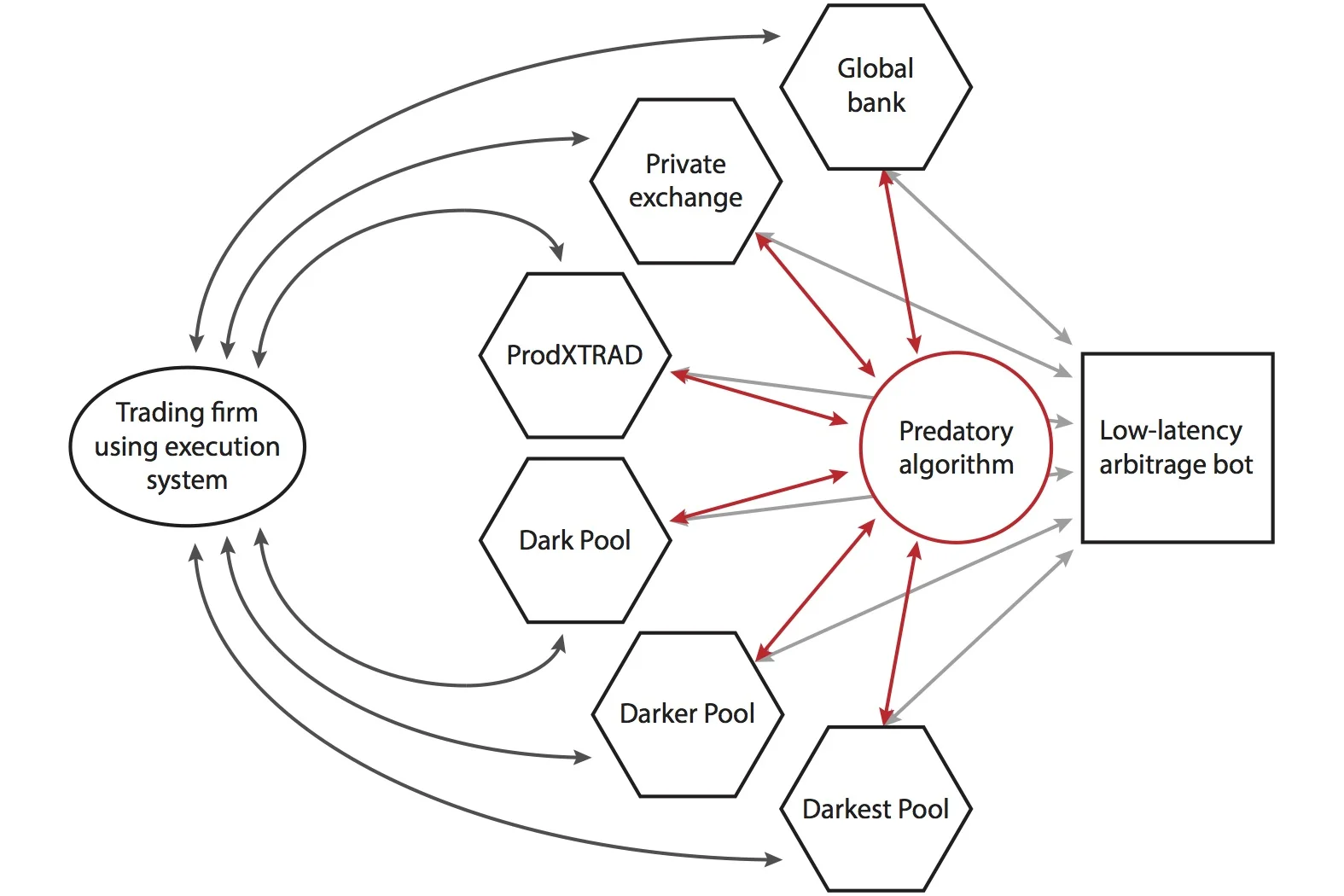

How to identify and categorize the various types of firms present in the market, understand their motivations and know the types of business activities they typically undertake. We explore the transactional ecology, where some entities are seeking to acquire risk for a profit while others seek to shed risk for a fee.

Chapter 3 – Fundamental Analysis

Explores how analysts collect data, process it, and turn in into actionable information. How traders work with subject matter experts to develop a consensus of market opinion which, when contrasted with internal projections, leads to a perception that current prices are relatively too cheap or too expensive.

Chapter 4 – Technical Analysis

Studying charts of price fluctuations as a window into market sentiment and as a means of understanding the probability and magnitude of potential price responses to market events and new information.

Chapter 5 – Understanding Volatility

Learn how to observe and categorize the fluctuations in market prices, and how its characteristics affect liquidity and trader participation.

Chapter 6 – Understanding Risk

Explore how the market volatility combined with the trader’s positions translates into risk, how to measure risk and understand the potential P&L impacts of normal and extreme market fluctuations.

Chapter 7 – Developing a Cohesive Market View

How to combine fundamental information, a technical analysis, an assessment of market volatility, and risk implications into a view of the market. Having a view of the market is the primary task of any trader, and the remainder of the book will cover implementing the view and managing the resulting position.

Chapter 8 – Directional Trading Strategies

Directional trading strategies are the simplest, most immediate means of gaining exposure to the market. The chapter explores how to evaluate a pure long/short directional implementation of the trader’s view.

Chapter 9 – Spread Trading Strategies

Spread trading strategies involve offsetting long and short positions that are designed to profit from the convergence or divergence of the initial price relationship. How to evaluate various types of spread position implementations of the trading view.

Chapter 10 – Option Trading Strategies

Option trading strategies involve using instruments with complex, non-linear risk characteristics that can be used to take leveraged directional views, create structures that profit under specific, predetermined conditions, or take positions that profit from changes in market volatility. Understanding the basics of this complex topic and evaluating various types of option implementation.

Chapter 11 – Quantitative Trading Strategies

In some data-intensive markets it is possible⎯or necessary⎯to utilize a quantitative, machine-based approach to understanding the market and implementing trading strategies. Here is a look at how to evaluate different types of machine-based trading strategies as potential means of implementing the market view.

Chapter 12 – Evaluating Trades & Creating A Trading Plan

How to take the candidate directional, spread, option, and quantitative trading strategies and evaluate the best means of implementing the trader’s market view of the market. Once the trader has decided on their preferred strategy, she will create a trading plan that describes its implementation.

Chapter 13 – Trading Mechanics

After arriving at the optimal strategy for the current conditions and drafting a trading plan, the trader must accumulate the desired position. To efficiently operate in the market the trader must develop and maintain solid trading mechanics.

Chapter 14 – Managing Positions & Portfolios

Securing a position is not the end. A trader must continue to assess both the market and the viability of his thesis, and stand ready to take any necessary action to optimize the profitability of the trade.

Chapter 15 – Pricing and Hedging Structured Transactions

Traders exposed to deal flow at financial institutions will frequently be called on to assist with complex structured transactions, which can originate anywhere from the organic hedging needs of a producer or consumer to a sophisticated player looking to opportunistically shed or assume an esoteric exposure. The trader’s involvement can range from performing routine price discovery and hedging, to risk decomposition, extracting value from embedded optionality, and warehousing significant volumes of non-standard products. The chapter concludes with a practical example of pricing and hedging a common structured transaction.

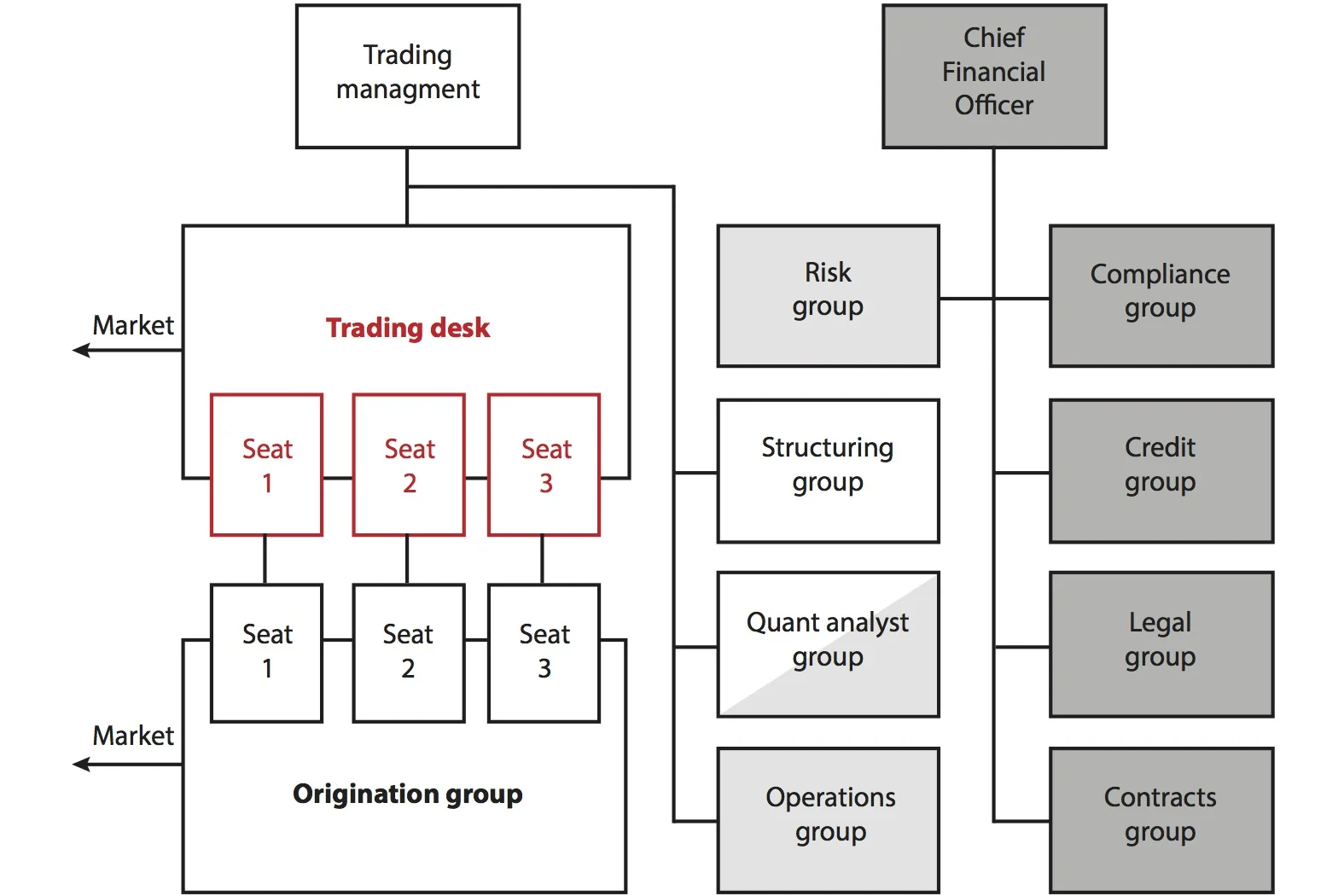

Chapter 16 – Navigating the Corporate Culture

Trading firms are complicated organizations, with a host of written and unwritten rules. A look at how things actually work, and how to avoid common pitfalls that derail trading careers. Just as markets evolve, traders progress through an evolutionary trajectory during their careers. How to avoid stagnation, diagnose technique flaws, and continue making progress.